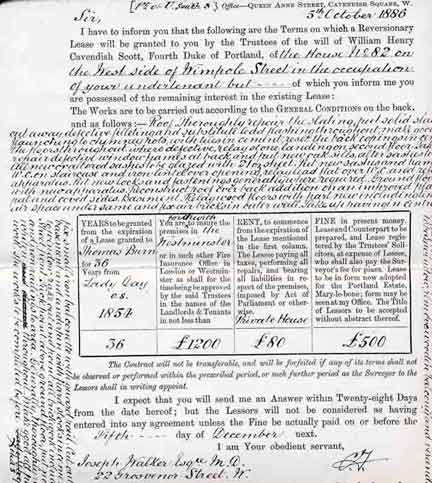

The lease of Victorian mystery writer Wilkie Collins at 82 Wimpole Street, in London. Leases were invented by aristocratic landowners, the Duke of Portland in this case, to ensure that something as substantial as land ownership was not sold off to common people. Oddly enough, it has survived as a form of residential tenure only in England and Wales (after being rather violently ended in Ireland; sensible Scotland never had it).

Michael Hollands was appalled to discover the expense and difficulty involved in extending a lease in a retirement site

There is one culprit in this unsatisfactory leasehold system that can end up being a big cost to leaseholders, particularly those who reside in retirement complexes: an even bigger cost than inflated management charges or exit fees.

That is the cost of extending a lease. Something I have found that the majority never consider.

If you do realise action is needed you will not get much help from government departments, property managers, their regulating associations or the freeholders.

They will just suggest you contact a solicitor or search the web for information.

I would like to record my experience as it may be a help to existing residents and prospective purchasers of these properties.

Last week I went to view a retirement property that was up for sale at £100,000.

It was originally a McCarthy and Stone development, with management fees payable to Peverel and ground rent of £275pa payable through Estates and Management to one of the Tchenguiz freehold owning companies.

The estate agent showed us round and I was impressed by the complex.

It was then that I discovered that the complex was built in 1997 and the flats had a 99-year lease.

This meant that there were only 81 years left and alarm bells started to ring.

I asked the agent if an extension had been granted. The answer was no, and why am I worrying when there is 81 years left.

I asked the complex manager if any other of the 45 flats had extensions and the answer was no.

I spoke to several residents and asked them if they were applying for one.

They had no knowledge of its importance, and said they were not worried. They would be long dead in 81 years.

I then looked at the LEASE website where they have a calculator for determining an approximate cost of extensions. On this particular property the cost would be £5,000/7,000 plus my own professional fees and those of the landlord.

I spoke to a solicitor who practises in lease extension and was told the landlord’s legal and surveying costs would be around £2,000 and mine around £1,000.

So it could in total amount to £10,000 on a property worth only £100000.

If the unexpired period gets under 80 years the cost rises as there is something called a marriage cost added. And costs further increase year by year.

One has to own the property for two years before applying, so in my case we would be below 80.

The solicitor said that in his experience very few of the leaseholders in retirement complex were aware of this. Prospective purchasers would be the same.

I contacted E&M to see if they would confirm these costs, but it would tell me nothing.

I think this industry must come up with a system to keep leaseholders and prospective purchasers fully informed of its importance.

Even if they are aware of it many elderly do not have access to information on the Internet, and expensive solicitors tend to be avoided.

I have asked the DCLG if it can help, but it just says information is on the web, particularly the LEASE website.

It is, in fact, investigating the costs of lease extensions, so there is hope but how many years will it be before a government takes action?

The Exit Fee Inquiry began in 2009 and action, if any, will not happen until at least 2017.

I have contacted Peverel / FirstPort, but this does not concern them as they are not the landlords or freeholders.

I have contacted ARMA but it, like the ARHM, does not reply to difficult questions.

Again it will just refer you to websites and solicitors.

I suspect that the landlords / freeholders are happy to see the lease run down.

So can anyone come up with a solution that will make all leaseholders aware that they must keep this under review?

I would like to see the management companies doing more to provide this information, as they are the ones in constant contact with the residents.

I think it should be a condition of ARMA Q membership. And estate agents should provide full information to prospective purchasers. The RICS could insist on this.

For information, the following is a good guideline.

Remember many of these complexes were built as long ago as the 1980s on a 99 year lease.

-

100 years unexpired. No problems with the property’s saleability

-

90 years unexpired Ditto

-

80 years unexpired. Marriage cost added and property market value affected

-

70 years unexpired. Cost of extending increases, mortgage lenders nervous and purchasers deterred.

-

60 years unexpired. As 70 years but worse, property value greatly reduced.

-

50 years unexpired. Mortgages probably unavailable. Cash buyers only, greatly reduced value.

-

End of lease period. Leaseholder may lose the property.

Many seem content to just let the lease run down as the period left far exceeds the remaining years they have to live.

But it will affect those who inherit, and even themselves, if they have to move out into alternative accommodation.

It is advisable to think of the property as money in the bank, and what affect all this has on its eventual value.

Otherwise it would be like leaving £100,000 untouched in a bank and seeing it gradually reduced to nothing.

As with the rest of this leasehold system it is the elderly residents who are disadvantaged.

There are free guides on (1) “statutory lease extension” and (2) “Calculation method of cost of lease extension ” which can be downloaded from http://www.lease-advice.org

Leaseholders after 2 years ownership of their flat , have a legal right to seek a statutory 90 years lease extension. The Council of Mortgage Lenders have set a policy not to offer mortgages if the unexpired lease term falls below 70 years. Also any extension of lease below 80 years will cost more due to inclusion of marriage value .

So its best to extend before the Lease falls below 80 years and get the lease extension without paying extra cost for marriage value.